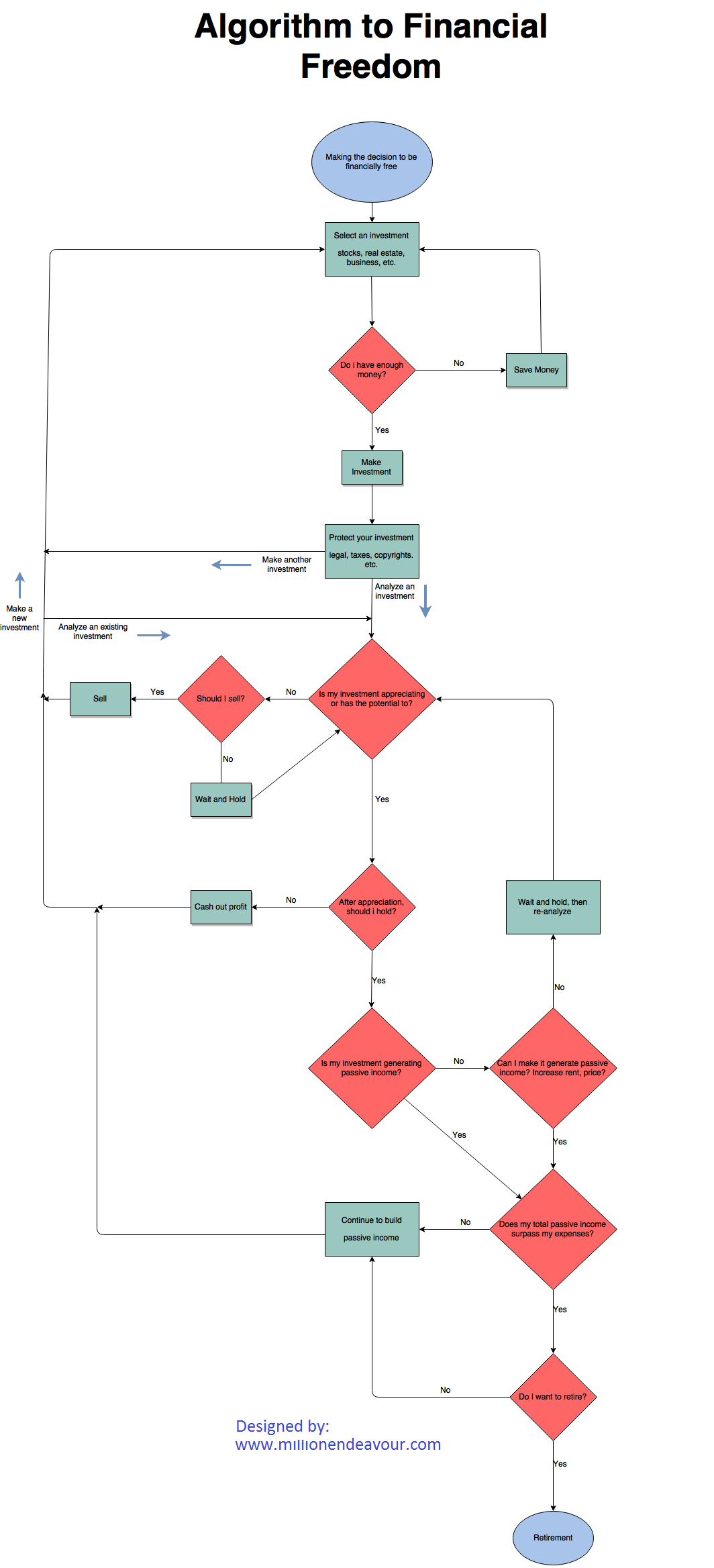

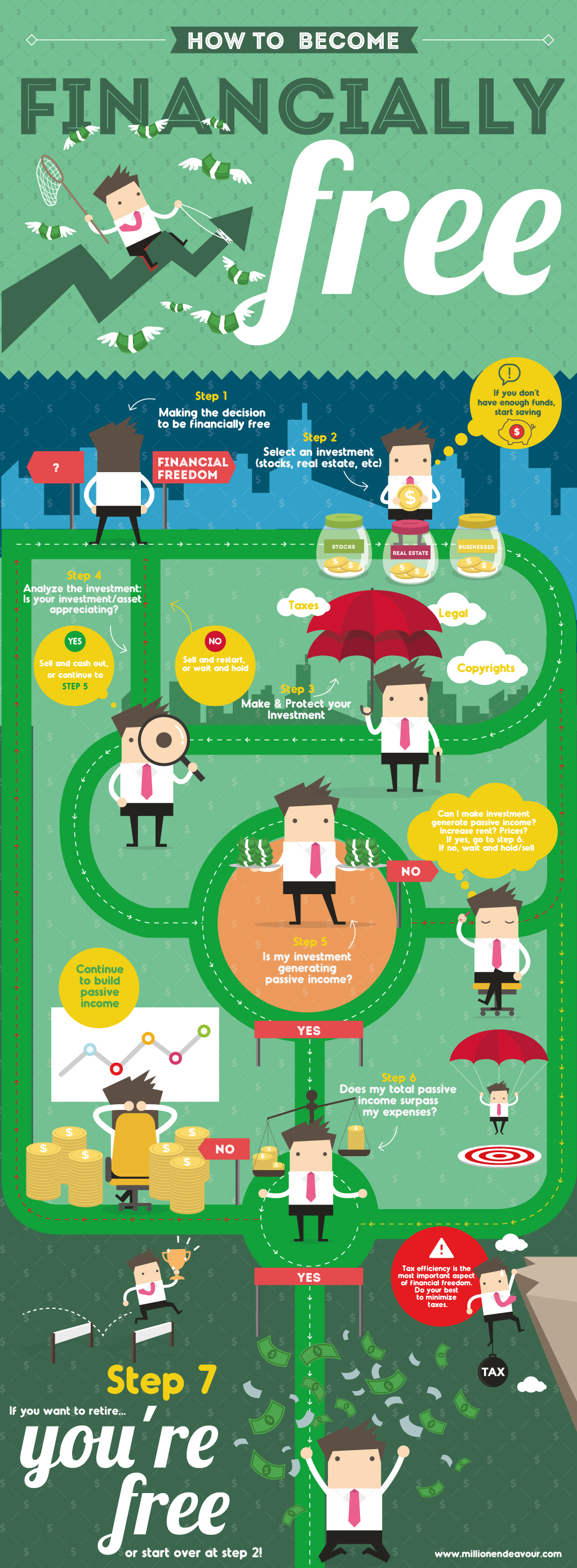

Step by Step Guide: How To Become Financially Free

Everyone dreams of the day when money is no longer preventing them from living life to the fullest.

However, to arrive at financial freedom, you will need some sort of map or blueprint. Without one, you could be wondering around for a while, perhaps even heading towards the opposite direction.

In this post, I will share with you an algorithm and blueprint that I have developed on how to become financially free.

This is a step by step guide which I will be using for my own personal journey and I believe that you may find it entertaining at the very least.

1. Making the decision to be financially free

The first step on how to become financially free is to actually make the decision to be.

Sounds simple enough?

For most, the possibility of retiring early may seem to be out of reach. It is nothing but a dream that most people would like but don’t believe is feasible.

However, the thought of financial freedom must first register with the brain before it can become a reality.

As knowledge in personal finance increases, the path will start to get clearer.

2. Decide on the next investment

After deciding that you want to be financially free and realizing that it is possible, you will need to start making some investments.

In most cases, an investment will fall under one of these three types: stock, business or property.

Stock

There are two types of stock investing.

- Passive investing

- Active investing

Passive investing is a form of investing where you can just sit back and let a professional manage your stock portfolio. This is typically done through either mutual funds or index funds.

In these funds, a portfolio manager will be responsible for managing your holdings. Your only responsibility would be to choose when to buy or sell your shares.

Active investing is the opposite of passive investing. This requires you to manage your own portfolio by choosing how many shares of which stock you would want to buy or sell.

I would definitely recommend that beginners look into passive investing especially if they are new to the stock market. A well managed fund will out perform most investors who choose the active route.

Business

Here are two ways to invest in a business:

Starting up a new company

Start ups can be quite time consuming and may even be expensive depending on what type of business you are interested in.

Blogging however, is an excellent way to start a business as it doesn’t require much start up capital.

Purchasing a business

You may also want to explore the option of purchasing an established business and taking it over from the current owner.

Although expensive, you will inherit a working business model along with any existing clientele.

Property

The third form of investment is in real estate. Here is a quick list of some property types you may want to look into:

- Condominium

- House

- Duplex, triplex, quad-plex, 8-plex, 16-plex

- Apartment building

- Retail property

- Raw land

Remember to always do your due diligence in research before making ANY investment.

Do you have enough money to make the investment?

If your answer is yes – is your investment the best one you can make at this time? Will it make you go in debt?

If your answer is no – you will have to find a way to increase your savings. You can do this by clocking in more hours at work, cut your living expense or by being more frugal.

DO NOT forget the option of borrowing money to make an investment. If the math makes sense, leveraging can be a powerful tool to utilize. Debt does not always have to be bad.

3. Protect your money

Once an investment is made or even before it is made, do take some time to make sure it is protected.

Failure to do so could result in either loss of money or unnecessary legal complications.

- Are you sheltering your money in tax free accounts?

- Do you have all the legal documents in order for your property or business?

- Are your products patented to prevent others from stealing your idea?

- Are your investments properly insured?

- Are you bleeding money where you shouldn’t be?

- Are your investments diversified?

- Am I missing anything? Feel free to add them in the comments. I will update the list.

At this point, you can either make another investment (step 2) or analyze one of your existing investment in (step 4).

4. Is your investment appreciating?

After you have at least one investment, you will need to analyze it further to determine what to do next. Otherwise, you would be stuck in an infinite loop of constant acquisition and not move forward.

I do not believe it is possible to retire in this infinite loop (step 2-3). Without ANY form of analysis or number crunching, it would be impossible to determine whether retirement is feasible.

The first thing to figure out in the analysis is to determine whether the investment is appreciating or has the potential to appreciate. Appreciation occurs when the investment is presently worth more than its original value.

If the answer is yes – After appreciation,

- Sell and cash out the profit, then make a new investment (step 2) or analyze an existing investment (step 4) or

- Continue to (step 5).

If the answer is no – you could either…

- Cut your losses and sell, then make a new investment (step 2) or analyze another investment (step 4) or

- Wait to see if the investment will appreciate and proceed to the start of (step 4).

5. Is your investment generating passive income?

The secret to financial freedom is to generate passive income from your investments.

Passive income is a form of income where you do not trade your time for money. Once it is set up, money will be coming in even when you are asleep!

Some examples of this would include: positive cash flow from rent, royalties, advertisement earnings and dividend income.

If the answer is yes – proceed to (step 6).

If the answer is no – is there a way to generate passive income from the investment?

In some cases, it could be as simple as increasing rent or product prices. If you do manage to squeeze some passive income out of your investment, proceed to (step 6).

However, if that is not an option, it would be best to hold on to the investment as it is still an appreciating asset.

There is always the option of re-analyzing it for passive potential at a later date (step 4).

6. Does my total passive income surpass my expenses?

Financial independence is achieved when passive income surpasses the expenses. At this point, it is only a matter of time before you become “financially free”.

There is a difference between financial “independence” and “freedom”. In freedom, you are able to achieve anything you want in life without having money as an obstacle. In independence, you may be able to quit your job but are not able to do anything you want just yet.

Do you have enough monthly passive income to cover for your living expenses?

If the answer is yes – proceed to (step 7).

If the answer is no – continue to build passive income by making more investments (step 2).

7. Do you want to retire?

The last step on how to become financially free is simply wanting to retire.

I know many people out there who can retire but choose not to. The reason for this is because they would rather keep themselves busy doing something instead of sitting around doing nothing.

Should you decide to retire at this step, you may do so as your passive income will sustain your expenses and the cost of living.

Otherwise, continue to build passive income by returning to (step 2).

These are the 7 steps that I have mapped out for those interested in how to become financially free.

Did I miss anything that you believe should be in this algorithm? Let me know in the comments! I want to know!

I like your step by step workings Jeff. The one that we’re working on most is #6, making our income more than expenses. There’s a long way to go!

Tristan

Step 6 is the most difficult step! I look forward to reading your progress on your blog. 🙂