My 7-Year Plan to One Million Dollar

I am one of those people who would like to have a well thought out plan before tackling anything. Instead of just jumping into things head on, I like to deconstruct the process first. This is no different for my goal to achieve one million dollar by the year 2020.

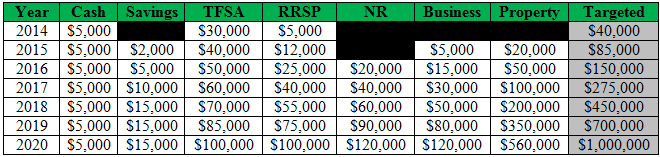

Some people may say that my goal of one million dollar within a 7-year time frame is very if not too ambitious. However, after spending all week crunching the numbers, I have been reassured that this endeavour is quite feasible. In an overview, this is how my financial timeline currently stands:

2014 – $40,000

2015 – $85,000

2016 – $150,000

2017 – $275,000

2018 – $450,000

2019 – $700,000

2020 – $1,000,000

Distribution of Net-Worth

My plan to achieve a net worth of one million dollar is divided into 6 main sectors. Although they are all equally vital to my success, they hold different weight. This is how I plan on distributing the one million:

- Cash – 2%

- Tax Free Savings Account (TFSA) – 10%

- Registered Retirement Savings Plan (RRSP) – 10%

- Non-Registered Account – 10%

- Business – 12%

- Property – 56%

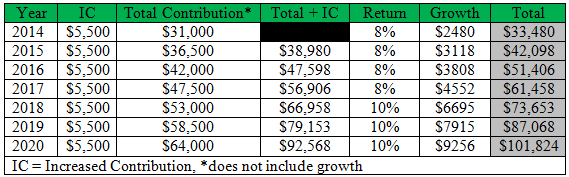

Tax Free Savings Account ($100,000)

The TFSA is a registered account that provides growth in investments without being subjected to tax. Although I am not familiar with how banking in the U.S works, the TFSA should be similar to the Roth IRA except with some minor differences. For those who are interested in learning more about TFSA, I have written a post about it in the past.

Assumptions made on the chart:

- Contribution limit will increase by $5,500 every year

- 8% return rate on investment from 2014 to 2017, 10% return rate from 2018 to 2020

- Knowledge of stock trading increases to achieve the 10% return rate by 2018

- Assumes contributions are made at the start of the year

Return on Investments

Although it is hard to predict how well the market will perform from 2014 to 2020, the return rate is only a targeted growth for that year. I have taken into account that some of these years may underperform while others may perform better. In any case, the average targeted growth for all 7 years should be around 9%.

Requirements

To achieve a TFSA portfolio value of $100,000, I will be required to contribute $5,500 every year into my account. Assuming that I have already maximized my portfolio which I am already close to doing, I will only need to contribute $33,000 over a period of 6 years. I don’t see how that will be any obstacle.

Of course, the other requirement is that I achieve a targeted average of 9% growth over the 7 years. This will be more of a challenge. I can either start increasing my knowledge in stock trading or put all my money into an index fund. However, I don’t think I’ll hit my targeted growth should I go with the second option. Guess it is time I start hitting the books!

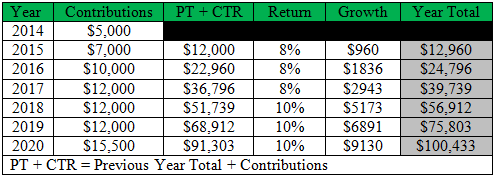

Registered Retirement Savings Plan ($100,000)

The second tax-free account available to Canadians is the Registered Retirement Savings Plan. For those who are in the U.S, the RRSP is similar to the 401K. Unlike the TFSA, withdrawals from the RRSP will be subjected to tax. This shouldn’t be that big of problem because by the time I withdraw from my account, I should be in a lower tax bracket.

Assumptions made on the chart:

- Contribution room will increase

- 8% return rate on investment from 2015 to 2017, 10% return rate from 2018 to 2020

- Knowledge of stock trading increases to achieve the 10% return rate by 2018

- Assumes contributions are made at the start of the year

Contributions

The biggest question in terms of my RRSP section of the plan is the contributions. Since I am only allowed to contribute 18% of my income every year into my RRSP, I may not meet my contribution goal.

This shouldn’t be a problem right now because I have a full time job. However, at some point of my financial journey, I plan on quitting my job to start up my own business. I am unsure if I can pay myself enough of a salary to meet my required contribution for the year. This will be something I will look into more closely when that time comes.

Requirements

Similar to the TFSA, there are two requirements for the RRSP. The first requirement is a total contribution of $73,500 over a 7 year time-frame. Although my company offers match contributions to my RRSP, I have every intention to quit in the near future.

Increasing my knowledge in stock trading is also vital in achieving the 9% average growth in my RRSP and non-registered account.

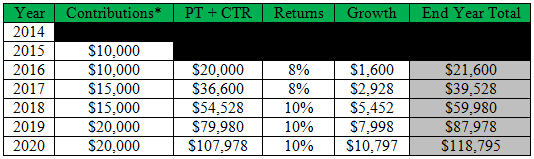

Non-Registered Account ($100,000)

The non-registered account is potentially my fourth sector in the plan. I say potentially because unlike the TFSA and RRSP, a non-registered account is subjected to capital gain tax. The upside to it is that this account has no contribution limit.

With that being said, I am also not a big fan of being so exposed to taxes. In the future, I may just eliminate the non-registered account from my plan completely and allocate the $100,000 into the other sectors. For the time being, I’ll just include it until I look into this further.

Assumptions made on the chart:

- 8% return rate on investment from 2016 to 2017, 10% return rate from 2018 to 2020

- Knowledge of stock trading increases to achieve the 10% return rate by 2018

- Assumes contributions are made at the start of the year

- Total should amount to $100,000 after taxes

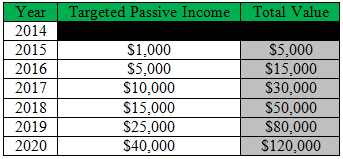

Business ($120,000)

The business section is the biggest question mark in my 7-year plan. At the present moment, I don’t have much to say about it except that I will be starting one. The plan is to get it launched by 2015 or at the very latest early 2016. Initially, I will be very involved in the business but the ultimate goal is to turn it into passive income.

Although, I have a few ideas of where I want to go with this, I am still in the planning stage. All I know for sure is that starting my own business is crucial in my journey to one million dollar. I will post updates as soon as I have any.

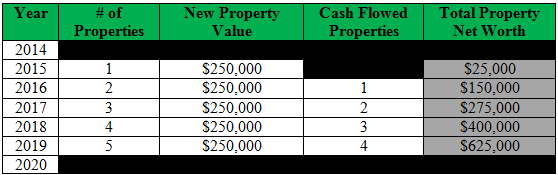

Property ($560,000)

By the start of next year, my friend (who actually got me interested in personal finance) and I will be coordinating in a joint effort to start investing in real estate.

The plan is to start looking around for properties around the $250,000 price range that have the opportunity to be cash flowed (rented out). Each of us will put down half of the $50,000 (20% required) for the down payment.

The ultimate goal by the end of 2019 is to have 5 properties of which 4 are rented out. This will put me and my friend at a net worth of $625,000 each in the property sector.

Assumptions made on the chart:

- Every new property has a value of $250,000

- The joint effort is between my friend and I only

- The first property investment is in 2015

- Property will be sold at a higher price

Calculation of Property Net-Worth

When calculating net worth on our property investments, I consider all cash flowed properties to be the full property value. The reason for this is because the rent will pay for the mortgage. This is why when a property is rented out; both of our net worth will increase to $125,000 each. My total property net worth number also takes into account of the initial down payment required, positive cash flow from rent and assumes that the property will be sold at a slightly higher price. Am I being too generous with myself? : )

No Property in 2020

I have left the year 2020 empty chart for a couple of reasons. The first being that one of the years leading up to then may not be a good time to invest in real estate. If this is the case, I will have an extra year to get up to 5 properties in total. The second is because my friend has a goal to achieve one million by 2019 and the year is irrelevant.

Final Thoughts

This concludes my 7-year plan to one million dollar. Although it is far from being perfect, I am glad that I have finally crunched some numbers and have a place to start. I am almost certain that I will come back to this post in the future and tweak it around as my knowledge in personal finance increases. Stay in touch until then!

What do you think of my 7-year plan? Do you have a plan to financial freedom? I would love to read all about it and maybe get some ideas. Feel free to link it in the comments if you have one!

Thanks for sharing your master plan. Quick question, do you think real estate prices are a bit too optimistic in canada at the moment?

Hi Henry, I do think real estate prices are very optimistic right now because the mortgage rates offered by the banks is very attractive especially in a bull market. This is why many people are looking to purchase new homes.

In fact, many banks are still offering a less than 4% fixed rate for a 25+ year loan in Canada right now. This 4% can be easily achieved through the smith maneuver. However, I do think it is only a matter of time before these rates start correcting itself.

Very Cool that you have a set plan for the next 7 years.

Hi – not to be a negative Nellie, but I want to challenge some of your assumptions. (Note – I’m not saying they are wrong, just want to start the discussion and have you explain your logic a bit more).

So, you currently are 25, make good money in a government job, but plan on quitting in the next ? year? or so. You plan on putting 5500 into your TFSA, 5000-12000 per year into your RRSP, 10 to 20000 into non-registered investments, start a business that generates 1000 increasing to 40000 per year and invest 25000 per year in real estate. My quick math says that is 45 500.00 of investment every year, assuming no input into your business venture. On top of this, you need to live (food, shelter, occasional fun) and I assume there would be some costs to starting your business and doing real estate deals (legal fees, accounting etc). I assume you are single with no kids, so certainly would be able to live on a minimal amount, but this still assumes you are bringing in a pretty significant amount of money in order to make the above investments. I guess my question is, where’s all that money coming from? That is part of your plan that isn’t explained – all the other numbers add up (although you may be a little on the optimistic side for returns based on my experience – but nothing wrong with aiming high). In any case, I wish you luck with your plan. Take care.

Hi Chris! Thanks for stopping by, you do bring up some valid concerns. Initially I wanted to answer your question here but I ended up going more than 900 words so I decided to put it all in a post.

You can check out my response here! https://www.millionendeavour.com/7-year-plan-explained/

Hi Jeff,

The plan looks aggressive but it’s certainly a great target!

Could you explain further why you’re ignoring your mortgage debt as part of your net worth calculation? I get that the RE property is cash-flow neutral, and the $25,000 for the first year shows your half of the house equity, but in year 2, it jumps $125k to $150,000 which looks like your half of the second $250,000 house value. You’ll still owe your half of the mortgage debt which I’m guessing will be around $240,000 at the end of year 2.

Are you relying on any particular housing price increase to reach your target and what kind of mortgage loan period / rate are you anticipating to pay? Don’t forget to account for any insurance and property taxes that need to be paid unless that’s factored into the mortgage amount.

Best wishes on your journey!

-DL

Hi DL,

My answer to your question may seem a little unorthodox. The reason why I don’t take into account the mortgage debt on my properties is because I don’t see mortgage as a debt. I see mortgage as purely an asset or investment and an opportunity to cash flowed through rent.

I don’t see mortgage as a debt because there is always the option of selling the house which will simply wipe out the mortgage and selling a property wont be an issue if the property is valuable in the first place. On top of that, when the property is cash flowed, it will pay for the mortgage and it is essentially like not having any debt at all. It is only when I decide to live in the property myself do I consider mortgage as debt.

Student loans on the other hand, now that is a debt. After all, I can’t go back and ask for refund on my tuition! Anyhow, I digress. Back on the subject…

The plan for 2015 is to search for a property and put down $25,000 as half of the down payment and to do the same for 2016. That will cover $50,000 of the 2016 value. I have also given myself 1 year to find a prospective tenant for my first property and that is where the remaining $100,000 will come in when the property is rented out.

Assuming that the first property is worth $250,000 and I am going half in with my friend, once the first property is rented out, my net worth for the first property would be $125,000. Also by 2016, I would have expected to put down another $25,000 as a down payment on a 2nd property totaling to the $150,000 sum as seen on the chart.

As for the land transfer tax, lawyer fees, home inspection & appraisal and insurance, I will probably make all of that back assuming that there is positive cash flow from the rented properties.

Of course this is all just a rough plan and it is not the final copy. Are there any discrepancies with what I have said so far? If so, do let me know as I am always trying to perfect it. Thanks for your valuable input!

A seven year plan is better than no plan! Even if you don’t get there, you will probably go farther than if you didn’t think things through.

What is your age and estimate income now?

Sam

Hi Sam! Thanks for dropping by!

Indeed. Even if I don’t make it in 7 years, it is the journey that will count and not the ending point.

I am 26 now and I make about 60k a year right now through my job. However, my plan isn’t to save all that work income to 1 mil. I plan on getting there through stocks, properties and starting a business.